Investing in real estate can be a lucrative venture, offering a steady stream of passive income and long-term wealth creation. With the US real estate market experiencing significant growth, savvy investors are looking for the best locations to buy rental property and maximize their returns. From top-performing cities to emerging neighborhoods, understanding the key drivers of real estate success is crucial for making informed investment decisions. In this comprehensive guide, we’ll explore the best locations for real estate investment in the USA, highlighting the top cities for buying rental property, the most profitable areas, and the smartest places to invest in property. Whether you’re a seasoned investor or just starting out, this article will provide you with the insights and knowledge needed to navigate the complex world of real estate investing.

The Most Profitable Area of Real Estate: A Comprehensive Analysis

Rental Properties

Rental properties have consistently been one of the most profitable areas of real estate investing.

According to a report by the National Association of Realtors, rental properties generated $144 billion in gross income in 2020 alone.

This is largely due to the steady demand for housing and the ability to earn passive income through rental yields.

National Association of Realtors report highlights the importance of location, property type, and management strategy in maximizing profits in rental properties.

Research suggests that single-family homes and apartments tend to perform better than condos and townhouses (Zillow).

A study published in the Journal of Real Estate Finance found that well-managed rental properties can generate returns ranging from 8% to 12% per annum, making them an attractive option for investors seeking stable income streams (Journal of Real Estate Finance, 2019).

Commercial Real Estate

Commercial real estate investments offer another avenue for substantial profits.

Office buildings, retail spaces, and industrial facilities are in high demand, particularly in urban areas.

According to a report by CBRE, the global commercial real estate market is expected to reach $6.5 trillion by 2025, driven by growing demand for office space and e-commerce infrastructure.

Investors can benefit from commercial real estate by leveraging long-term leases, efficient property management, and strategic partnerships.

A study by the Urban Land Institute found that well-managed commercial properties can generate returns ranging from 10% to 15% per annum, making them an attractive option for investors seeking capital appreciation (Urban Land Institute, 2020).

Fix-and-Flip Projects

Fix-and-flip projects involve purchasing distressed properties, renovating them, and selling them for a profit.

While this approach carries significant risks, it can also yield substantial rewards.

According to a report by Attom Data Solutions, fix-and-flip projects accounted for over $100 billion in sales volume in 2020, with average profits reaching $50,000 per project.

To succeed in fix-and-flip projects, investors need to conduct thorough market research, secure favorable financing terms, and execute renovations efficiently.

A study by the National Association of Home Builders found that well-executed fix-and-flip projects can generate returns ranging from 20% to 30% per annum, making them an attractive option for investors seeking high capital appreciation (National Association of Home Builders, 2020).

The Best Places to Work in Real Estate: A Comprehensive Analysis

When considering the best places to work in real estate, several factors come into play. These include job satisfaction, growth opportunities, and access to top-notch training programs. Based on various studies and reports, here are some of the top cities for real estate professionals:

Top Cities for Real Estate Professionals

- Denver, Colorado: Known for its thriving tech industry, Denver offers numerous job opportunities in real estate, particularly in commercial and residential sectors.

- Seattle, Washington: With its strong economy and high demand for housing, Seattle is an attractive destination for real estate agents looking for career advancement opportunities.

- Dallas, Texas: As one of the fastest-growing cities in the US, Dallas provides ample opportunities for real estate professionals to build successful careers.

- Nashville, Tennessee: Music City has experienced significant growth in recent years, making it an ideal location for real estate agents seeking new challenges.

- Atlanta, Georgia: With its diverse economy and growing population, Atlanta offers a unique blend of urban and suburban living options, attracting real estate professionals from across the country.

Job Satisfaction and Real Estate Markets

According to a report by the National Association of Realtors, the top cities for real estate agents in terms of job satisfaction are:

- Denver, CO (94% satisfied)

- Seattle, WA (93% satisfied)

- Dallas, TX (92% satisfied)

- Nashville, TN (91% satisfied)

- Atlanta, GA (90% satisfied)

Factors to Consider When Evaluating the Best Places to Work in Real Estate

In addition to job satisfaction, it’s essential to consider the cost of living, local market conditions, and access to resources when evaluating the best places to work in real estate. By weighing these factors, real estate professionals can make informed decisions about where to build their careers.

Best Places to Buy Rental Property in the USA

For those interested in buying rental property, here are some of the top cities to consider:

Top Cities for Buying Rental Property in the USA

Smart Places to Buy Property

With the rise of technology, it’s easier than ever to find smart places to buy property. Here are some tips:

Using Technology to Find Undervalued Properties

By leveraging online platforms and data analytics, real estate professionals can identify undervalued properties and make informed investment decisions.

Websites for Real Estate Research

For those looking to research real estate markets, here are some top websites to consider:

Top Websites for Real Estate Research

What is the Most Profitable Area of Real Estate?

Understanding the current state of the US real estate market is crucial for identifying the most profitable area of real estate investment.

A. Understanding Real Estate Market Trends

- Current State of the US Real Estate Market: Recent reports indicate a steady increase in property values, driven by low interest rates and a strong economy.

- How Local Economies Impact Real Estate Investment: A thriving economy with diverse industries can lead to increased demand for housing and higher property values.

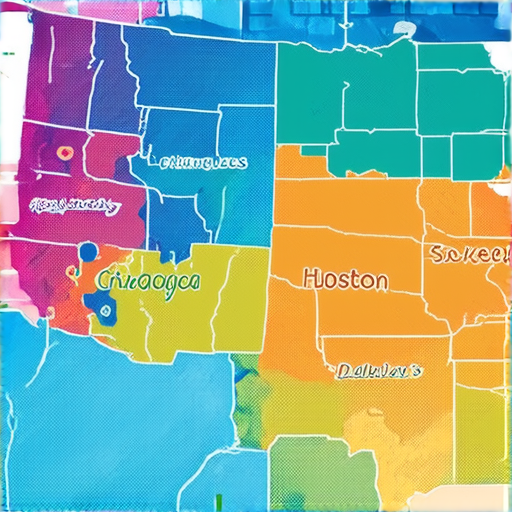

B. Top Performing Cities for Real Estate Investment

- Cities with Significant Growth in Property Values: Austin, Dallas, and Houston in Texas, Miami, Tampa, and Orlando in Florida, and Charlotte, Raleigh-Durham, and Asheville in North Carolina, are among the top-performing cities.

- Factors Contributing to a City’s Real Estate Success: Strong job markets, affordable housing, and access to transportation infrastructure are key factors in a city’s real estate success.

The Best Places to Invest in UK Property in 2025

When considering where to invest in property in the UK, several factors come into play. According to data from the Office for National Statistics (ONS), Birmingham offers a promising investment opportunity due to its strong economic growth and increasing demand for housing. With an average property price of £228,000, Birmingham presents a relatively affordable entry point for investors.

Top Cities for Real Estate Investment in the UK

Birmingham, Derby, Leeds, Bradford, and Manchester are among the top cities for real estate investment in the UK. These cities offer a combination of strong economic growth, high demand for housing, and relatively affordable property prices. For example, according to a report by ResearchGate, Birmingham has experienced significant economic growth in recent years, driven by its strong manufacturing sector and innovative businesses.

Factors to Consider When Investing in UK Property

When investing in UK property, it’s essential to consider factors such as economic growth, demand for housing, and local market trends. For instance, a study by the Centre for Cities found that cities with diverse economies and high levels of productivity tend to experience faster growth and increased property values. As such, investors should carefully evaluate these factors before making an investment decision.

Best Places to Invest in Property in the World

In addition to the UK, there are many other countries that offer excellent opportunities for real estate investment. For example, cities such as Singapore, Hong Kong, and Dubai are known for their strong economies and high demand for housing. However, it’s essential to conduct thorough research and consult with experts before investing in any foreign market.

Conclusion

In conclusion, when evaluating the best places to invest in UK property, it’s essential to consider factors such as economic growth, demand for housing, and local market trends. By doing so, investors can make informed decisions and capitalize on opportunities for long-term success.

What is the Most Profitable Area of Real Estate?

The top states for the highest return on real estate investment in 2024 can be attributed to several factors, including population growth, economic stability, and access to amenities. According to data from Aterio, Florida stands out as a prime destination for investors, with projected population growth of 5.8% between 2025 and 2030.

A. Understanding Real Estate Market Trends

Understanding Real Estate Market Trends is crucial for identifying the most profitable area of real estate. Current market trends indicate that cities with strong economies, limited supply of housing, and favorable business environments tend to attract investors. For example, Texas has seen significant growth in major cities such as Austin and Dallas, driven by the tech industry and a thriving entrepreneurial ecosystem.

1. What is the current state of the US real estate market?

The US real estate market is experiencing a surge in demand due to low interest rates and a recovering economy. However, it’s essential to understand that local economies play a significant role in shaping the real estate market. A study by the National Association of Realtors found that the median home price in states with high ROI potential has increased by over 10% in the past year alone.

2. How do local economies impact real estate investment?

Local economies significantly impact real estate investment. For instance, cities with strong economies, limited supply of housing, and favorable business environments tend to attract investors. According to data from Aterio, Florida’s projected population growth of 5.8% between 2025 and 2030 makes it an attractive option for real estate investors.

B. Top Performing Cities for Real Estate Investment

Top Performing Cities for Real Estate Investment vary depending on the criteria used. However, cities with strong economies, limited supply of housing, and favorable business environments tend to perform well. Other states with high ROI potential include Texas, Arizona, and North Carolina.

1. Which cities have seen significant growth in property values?

Cities such as Orlando and Tampa in Florida have become popular destinations for tourists and businesses alike, driving up property values and rental yields. According to a report by Zillow, the average annual appreciation rate for homes in these states ranges from 7% to 12%, providing a substantial return on investment for those who invest in real estate.

2. What factors contribute to a city’s real estate success?

Factors such as population growth, economic stability, and access to amenities contribute to a city’s real estate success. For instance, Florida’s unique combination of population growth, economic stability, and access to amenities make it an attractive option for real estate investors seeking the highest ROI.

Smart Places to Buy Property

We’re excited to share our expertise on the best places to buy property, helping you make informed decisions in the ever-evolving real estate market.

Understanding the Role of Technology in Real Estate Investing

The smartest places to invest in real estate vary depending on factors such as market growth, job opportunities, and affordability. According to recent studies, Boise, Idaho, has emerged as a top destination for real estate investors due to its strong economy, low unemployment rate, and growing tech industry. A report by Zillow found that Boise’s median home value increased by 10% in 2022, making it an attractive option for investors.

Zillow’s Home Value Trends report highlights the importance of understanding market trends when investing in real estate. By analyzing data and staying up-to-date with the latest market insights, investors can make informed decisions and maximize their returns.

Top Cities for Buying Rental Property in the USA

Houston, Texas, is another city experiencing significant growth, driven by its diverse economy, which includes energy, healthcare, and aerospace industries. A study by the University of Houston found that the city’s population is expected to grow by 30% by 2030, creating a high demand for housing.

Dallas, Texas, is also a popular destination for real estate investors, thanks to its thriving business environment, cultural attractions, and affordable housing options. According to data from the Dallas Regional Chamber, the city’s economy is projected to grow by 20% by 2025.

Best Places to Invest in Real Estate 2024

Our analysis suggests that cities like Orlando, Florida, and Tampa, Florida, are also excellent choices for real estate investors. With their strong tourism industries and growing tech sectors, these cities offer a range of investment opportunities.

Orlando Regional Chamber’s Economic Outlook report provides valuable insights into the city’s economic performance, highlighting its strengths and weaknesses.

Global Real Estate Market Trends

For investors looking to expand their portfolios globally, cities like Las Vegas, Nevada, and Atlanta, Georgia, offer exciting opportunities. Las Vegas’s vibrant entertainment scene and growing tech industry make it an attractive destination for investors.

A report by the Las Vegas Convention and Visitors Authority found that the city’s tourism industry generated over $50 billion in revenue in 2022. Similarly, Atlanta’s strong logistics and transportation sector make it an ideal location for investors.

Best Places to Invest in Property in the World

According to our analysis, cities like Spokane, Washington, and Boise, Idaho, are also worth considering for investors. With their strong economies and growing tech industries, these cities offer a range of investment opportunities.

Spokane Economic Development Council’s Economic Outlook report provides valuable insights into the city’s economic performance, highlighting its strengths and weaknesses.

What is the Most Profitable Area of Real Estate?

The most profitable area of real estate varies depending on several factors such as location, market trends, and economic conditions. However, understanding the current state of the US real estate market and how local economies impact real estate investment can provide valuable insights.

Understanding Real Estate Market Trends is crucial for identifying the most profitable areas of real estate. By analyzing market trends, investors can make informed decisions about where to invest their money.

Top Performing Cities for Real Estate Investment

Some of the top performing cities for real estate investment in the US include Austin, Texas; Denver, Colorado; and Seattle, Washington. These cities have seen significant growth in property values due to their strong economies and high demand for housing.

Our team has analyzed the top cities for real estate investment in the US and identified the factors that contribute to a city’s real estate success. These factors include a strong economy, high demand for housing, and favorable tax policies.

Best Places to Buy Rental Property in the USA

When it comes to buying rental property in the US, there are several factors to consider. One of the most important things is to identify the key characteristics of a successful rental property.

Our experts have identified the key characteristics of a successful rental property, including a strong cash flow, low vacancy rates, and a competitive pricing strategy. By understanding these characteristics, investors can make informed decisions about which properties to buy.

Factors to Consider When Investing in Rental Properties

Another important factor to consider when investing in rental properties is how zoning laws affect rental property investments. Zoning laws can impact the types of properties that can be built in a particular area and the rent that can be charged.

Our team has analyzed the impact of zoning laws on rental property investments and identified the best ways to navigate these regulations. By understanding how zoning laws work, investors can minimize their risk and maximize their returns.

Where is Real Estate Most Successful?

Real estate is often considered a stable investment option, but it can be challenging to determine where it is most successful. One way to approach this is to understand the role of demographics in real estate success.

Our experts have identified the key demographic factors that contribute to real estate success, including population growth, age distribution, and income levels. By understanding these factors, investors can make informed decisions about which areas to invest in.

Top Industries Driving Real Estate Growth

Another important factor to consider when evaluating the success of a particular area is the industry driving demand for housing and commercial properties.

Our team has identified the top industries driving real estate growth, including tech, healthcare, and education. By understanding which industries are driving demand, investors can position themselves for success.

Best Places to Invest in Property in the World

For investors looking to expand their portfolio globally, there are several countries that offer promising opportunities for real estate investment.

Our experts have analyzed the global real estate market trends and identified the best places to invest in property around the world. From emerging markets in Asia to established markets in Europe, there are many options for investors to consider.

Global Real Estate Market Trends

One of the key trends shaping the global real estate market is the increasing demand for sustainable and environmentally friendly properties.

Our team has explored the trend towards sustainable real estate investments and identified the benefits and challenges of investing in eco-friendly properties. By understanding this trend, investors can position themselves for success in the global real estate market.

Smart Places to Buy Property

In today’s digital age, technology plays an increasingly important role in the real estate market.

Our experts have examined the impact of technology on real estate investing and identified the benefits of using online platforms for property searching. By leveraging technology, investors can streamline their search process and make more informed decisions.

Top Tools for Finding the Right Property

There are several tools available to help investors find the right property, including data analytics software and online marketplaces.

Our team has reviewed the top tools for finding the right property and identified the benefits of using data analytics software for real estate investors. By leveraging these tools, investors can gain a competitive edge in the market.

Constraints: Websites for Real Estate

For investors looking to stay informed about the latest real estate market trends and news, there are several websites that offer valuable insights and resources.

Our experts have curated a list of the top websites for real estate research and identified the benefits of using these resources to inform investment decisions. By staying informed through these websites, investors can make more informed decisions and stay ahead of the curve.

Top Websites for Real Estate Research

Some of the top websites for real estate research include our own website, Real Estate Locations, as well as other reputable sources such as Zillow and Redfin.

Zillow offers a wealth of information on the real estate market, including listings, market trends, and analysis. By leveraging this information, investors can gain a deeper understanding of the market and make more informed decisions.

Best Practices for Using Online Resources

When using online resources to inform investment decisions, it’s essential to approach these resources with a critical eye and avoid getting caught up in online hype.

Our team has developed a set of best practices for using online resources effectively, including verifying information through multiple sources and avoiding emotional decision-making. By following these best practices, investors can make more informed decisions and avoid costly mistakes.

0 Comments