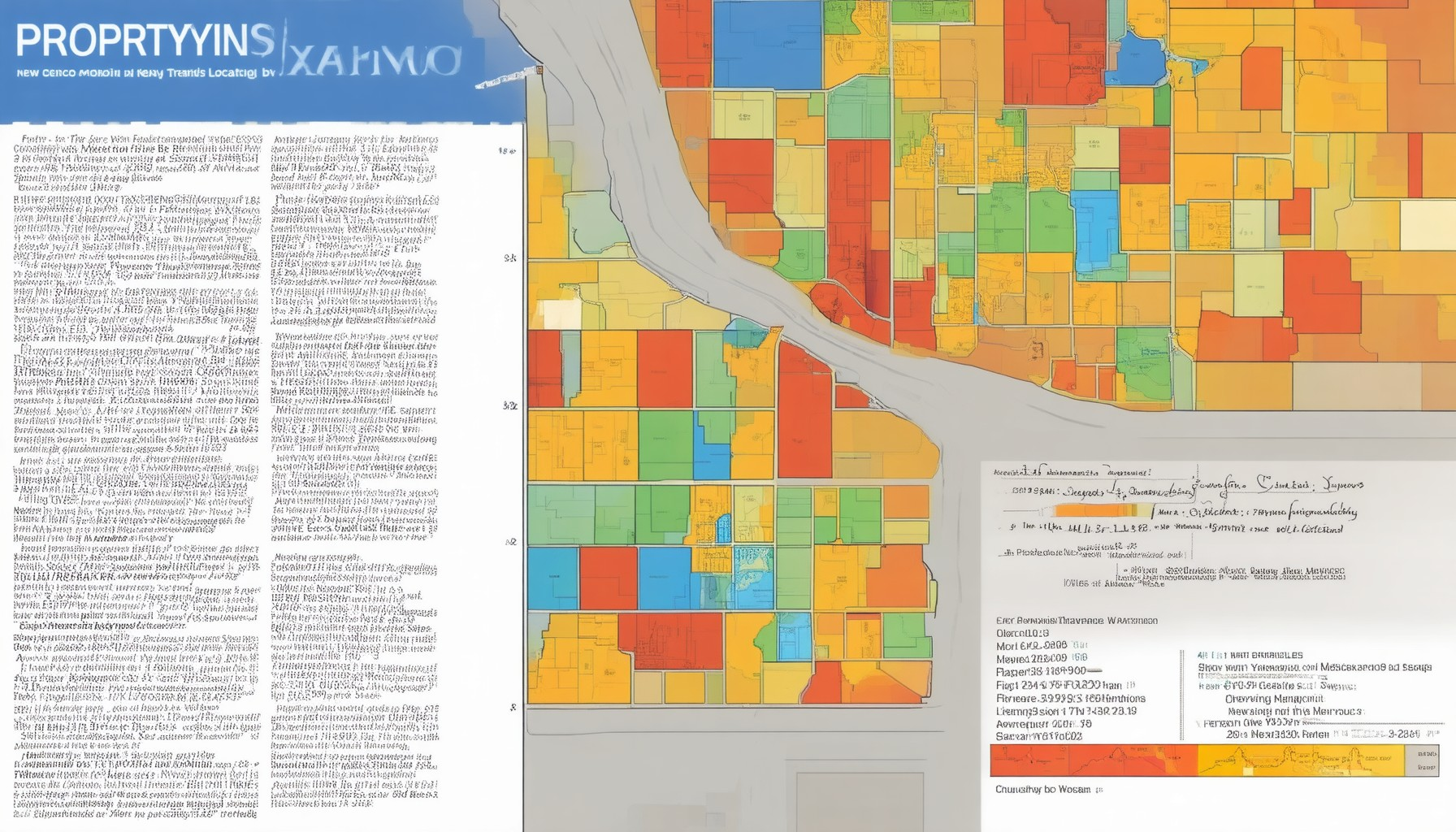

Understanding how property values change across different locations can provide valuable insights for anyone looking to buy, sell, or invest in real estate. In this comprehensive guide, we explore the intricate relationship between property trends and their geographical distribution, focusing specifically on New Mexico’s dynamic real estate landscape. By examining local market dynamics, economic influences, and seasonal variations, this article aims to shed light on where prices are rising or falling, helping readers make informed decisions based on current trends. From analyzing Zillow market trends by zip code to considering long-term projections, our goal is to offer a detailed look at how location shapes the future of New Mexico’s housing market. Whether you’re a first-time buyer, a seasoned investor, or simply curious about the state’s real estate trajectory, this exploration of property trends by location will equip you with the knowledge needed to navigate New Mexico’s evolving housing market.

Where Are Home Prices Dropping Most?

Home prices are decreasing in several major U.S. cities, driven by shifting market dynamics and economic conditions. Here are some of the areas experiencing notable price drops:

- San Francisco, CA : Known for its high cost of living, San Francisco has seen a significant drop in home prices recently. Factors contributing to this trend include an oversupply of luxury homes and buyer fatigue due to rising property taxes and strict zoning laws.

- Los Angeles, CA : Similar to San Francisco, Los Angeles has experienced a decrease in home prices, particularly in high-end neighborhoods. The region’s competitive housing market has led to price corrections in many areas.

- Austin, TX : As a rapidly growing tech hub, Austin has seen a slowdown in housing demand, leading to price reductions in many neighborhoods. This shift is partly due to concerns about high living costs and the city’s rapid population growth.

- Chicago, IL : Home prices in Chicago have dropped slightly in recent months, influenced by a mix of economic uncertainty and an increase in available properties. Buyers are taking advantage of lower interest rates and reduced prices in certain districts.

- New York, NY : The luxury housing market in New York City has been hit hard, with prices dropping in high-rise apartments and Manhattan condos. This decline is attributed to decreased demand and increased supply.

- Orlando, FL : A popular destination for second homes and retirees, Orlando has seen a noticeable drop in home prices. This is likely due to a slower pace of tourism and reduced demand for vacation homes.

- Phoenix, AZ : Phoenix, known for its warm climate and affordability, has experienced a modest price decrease. This trend is part of a broader shift in the Southwest real estate market, where prices have become more attainable for many buyers.

The price drops in these cities reflect broader market trends, including changes in buyer behavior, interest rate fluctuations, and economic conditions. It’s important for potential buyers to stay informed about local market dynamics and work with experienced real estate professionals to navigate these opportunities.

How Does Location Affect Property Price?

The value of a property is significantly influenced by its location, with various factors contributing to price differences. Here’s a breakdown of the key factors:

- Proximity to Amenities: Properties near schools, hospitals, shopping centers, and parks tend to sell for higher prices due to increased demand.

- Neighborhood Quality: Better-educated, higher-income neighborhoods often see higher property values as residents can afford more expensive homes and demand better amenities.

- Local Demand: Areas with strong job markets, good transportation, and access to entertainment attract more buyers, driving up prices.

- Nearby Attractions: Properties close to golf courses, beaches, or popular landmarks may fetch higher prices due to their unique appeal.

- Infrastructure and Accessibility: Good roads, public transport, and utilities can significantly boost property values in a location.

- Surrounding Areas: The condition and development status of neighboring properties can also impact overall pricing trends.

For instance, a property in a highly sought-after area with excellent schools and amenities might sell for tens of thousands more than a similar property in a less desirable location. Additionally, historical trends show that certain neighborhoods appreciate more rapidly than others, often due to improved infrastructure or increased demand.

When evaluating potential investments, it’s essential to consider long-term growth projections based on the area’s characteristics. Real Estate Locations offers detailed insights and expert analysis to help buyers make informed decisions tailored to their investment goals.

Competitors like Zillow, Realtor.com, and Redfin also provide comparable tools and resources for further exploration. Their platforms offer advanced search filters, mapping features, and market trend reports to aid in making educated choices.

Are Home Prices Dropping in NM?

As of recent data, the housing market in New Mexico has shown a slight decrease in home prices compared to previous years. The median home price in New Mexico was reported at $345,100 in January 2025, reflecting a 2% drop from the same period in the prior year. This decline indicates a cooling effect in the local real estate market, potentially influenced by economic factors such as interest rates and market supply.

The New Mexico housing market, like many regions across the country, is influenced by various dynamics. Factors contributing to the price drops include:

- Economic Uncertainty: Rising interest rates have made homeownership less affordable for some buyers, leading to decreased demand and, consequently, lower pricing.

- Market Supply: An increase in available properties has contributed to price adjustments, offering buyers more options and negotiation power.

- Seasonal Trends: Seasonal fluctuations in the housing market can also play a role, with certain periods seeing temporary dips in prices.

For those considering purchasing a home in New Mexico, it’s essential to stay informed about the current market conditions. Real Estate Locations offers comprehensive resources and expert advice to help buyers navigate the market effectively. Explore our guides on New Mexico housing market trends and investment opportunities to make well-informed decisions.

Whether you’re a first-time buyer or an experienced investor, understanding the local market dynamics can help you find the best deals and secure your ideal property. Keep an eye on market trends and leverage tools from trusted real estate platforms to stay ahead in your housing journey.

Where Are House Prices Falling Fast?

According to the latest market analysis, several regions across the United States are experiencing significant declines in house prices. These drops are influenced by economic factors, interest rate fluctuations, and shifts in buyer demand.

Top Areas Where House Prices Are Dropping

- Midwest Cities: Cities like Detroit and Cleveland have seen house prices drop by over 15% in the past year due to economic challenges and reduced buyer activity.

- Northeast Markets: In areas such as Boston and New York City , house prices have stabilized slightly, but certain neighborhoods still experience price reductions.

- Sunbelt Regions: While traditionally strong markets, cities like Phoenix and Las Vegas have seen slower growth, with some areas experiencing minor price declines.

Key Factors Driving Price Drops

The primary drivers behind these price reductions include:

- Economic uncertainty leading to decreased buyer confidence.

- Rising interest rates, making mortgage payments less affordable.

- Increased supply of available properties in certain regions.

Future Outlook

Experts predict that house prices may continue to stabilize or decline further in the near term, particularly in areas with ongoing economic challenges. Investors and buyers should monitor these markets closely for potential opportunities.

For more detailed insights and local market trends, visit our Real Estate Locations resource hub.

Will House Prices Drop if the Market Crashes?

If the housing market experiences a crash, it could lead to a decline in house prices. However, the impact would vary depending on several factors:

Factors Influencing Price Drops

- Economic Downturn: A recession or economic crisis often leads to reduced consumer spending and higher unemployment, which can decrease demand for housing.

- Interest Rates: Rising interest rates can make mortgage payments more expensive, discouraging buyers and leading to price reductions.

- Supply and Demand: An oversupply of homes relative to demand can push prices down.

- Market Sentiment: Fear and uncertainty during a crash can lead to a sell-off, further driving prices down.

Possible Causes of a Housing Crash

- Economic Uncertainty: Events like geopolitical conflicts, inflation, or financial instability can trigger a crash.

- Overvaluation: When home prices exceed sustainable levels relative to income or economic growth, a crash becomes more likely.

- Banking Crisis: Issues in the banking sector or credit market can disrupt lending and lead to widespread property value declines.

What to Consider as a Buyer

- Wait and Observe: If you’re not in a rush to buy, waiting for prices to stabilize might be wise.

- Take Advantage of Lower Prices: If you’re ready to purchase, a crash could present an opportunity to buy at a better value.

- Consult Professionals: Work with experienced real estate agents and financial advisors to navigate the market wisely.

For more insights into understanding housing market trends and preparing for potential fluctuations, visit our Housing Market Trends section.

When Are House Prices Lowest?

House prices generally reach their lowest in the winter months, particularly between December and January. This season sees reduced demand due to colder weather, fewer moving-related activities, and holiday distractions, leading to lower competition among buyers. Sellers may also delay listings during this period, further reducing inventory and driving prices down.

0 Comments