The real estate landscape in the United States continues to evolve rapidly, shaped by shifting market dynamics that vary significantly by region. From the bustling tech hubs like the Bay Area to rural communities across the country, the housing market exhibits unique patterns influenced by local economies, job growth, and demographic shifts. As we approach 2024, understanding these trends becomes essential for buyers, sellers, and investors aiming to navigate the ever-changing real estate environment. This comprehensive exploration delves into the forecasted housing market movements, offering insights into home price projections, regional variations, and expert predictions to guide your decisions in the coming year.

Key Takeaways

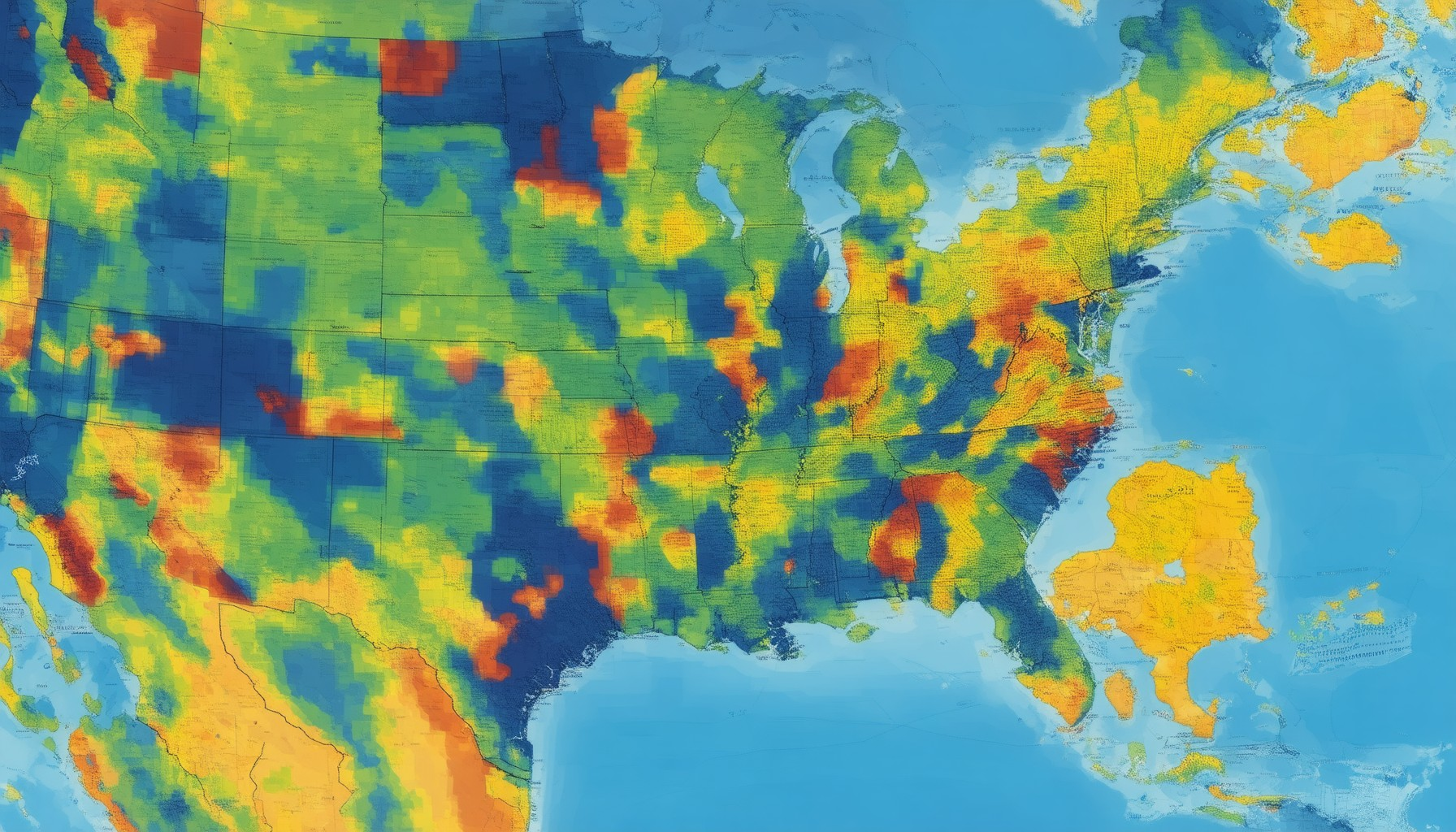

– The real estate market varies significantly by region, influenced by economic conditions, job growth, housing supply, and demographic trends.

– Regions with strong local economies and job markets experience higher demand and faster property appreciation.

– Areas impacted by economic downturns may face price drops or reduced activity.

– Urban areas with limited housing inventory see competitive pricing and seller’s markets, while regions with abundant supply offer more negotiating power for buyers.

– Demographic trends, including migration to urban/suburban areas and retiree relocation, are reshaping housing demand.

– Emerging markets may offer higher returns but come with higher risks, while established markets provide stability.

– In 2024, U.S. housing markets are expected to stabilize with modest appreciation, particularly in suburban areas due to remote work trends.

– Canada’s real estate market is projected to recover, driven by low interest rates and immigration.

– Western Europe is seeing steady growth, especially in urban areas with increased demand for sustainable housing.

– Eastern European countries like Poland, Hungary, and Romania are experiencing robust growth due to favorable conditions and foreign investment.

– China’s real estate market is rebounding post-COVID restrictions, while Japan’s market remains subdued.

– India’s real estate sector is poised for strong growth, led by cities like Mumbai and Delhi.

– Latin America faces volatility, while African markets like South Africa and Nigeria are expected to grow in prime locations.

– Home values in major U.S. metros like New York, Los Angeles, and Chicago are projected to appreciate by 8-12%, while suburban areas may see slight declines.

– Southeastern regions like Atlanta and Nashville are expected to experience the fastest growth, with home values increasing by 15-20%.

– Midwestern states like Kansas City and Minneapolis are anticipated to maintain stable home values.

– Investors should consult detailed reports and current data for informed decision-making.

Upcoming Real Estate Trends by Region

The real estate market is dynamic, influenced by various factors such as economic conditions, demographic shifts, and policy changes. Staying informed about upcoming trends can help investors and buyers make strategic decisions. Here’s a breakdown of the key trends expected in 2025 and beyond:

- Urban Growth in Major Metros : Cities like New York, London, Tokyo, and São Paulo are experiencing rapid urbanization. This trend is driving demand for properties in central locations, offering high returns due to infrastructure development and job opportunities.

- Affordability in Emerging Markets : Regions with developing economies, such as Southeast Asia, Africa, and parts of South America, are seeing increased accessibility. Governments are implementing affordable housing programs, making these areas attractive for long-term investments.

- Luxury Property Surge : High-net-worth individuals are investing in premium properties. Countries with strong economic growth, like India and the UAE, are witnessing a rise in luxury real estate demand, particularly in coastal cities and gated communities.

- Sustainable Housing Demand : There’s a growing preference for eco-friendly living. Regions with green building initiatives, such as Europe and Canada, are leading the market for energy-efficient and environmentally conscious properties.

- Remote Work Impact : The shift towards remote work has increased demand for properties in suburban and rural areas. This trend is expected to continue, influencing regional market dynamics.

Regional Trends

North America

- Suburban markets near major cities are gaining popularity due to remote work trends.

- Investors are focusing on U.S. Sun Belt states like Florida, Texas, and Arizona for vacation homes.

- CANADA: Vancouver and Toronto remain competitive, with a focus on mixed-use developments.

Europe

- BERLIN: The city is attracting investors with its booming tech sector and cultural appeal.

- PARIS: Luxury property prices are stabilizing, presenting opportunities for long-term holders.

- UK: Post-Brexit policies are shaping a unique market environment, particularly in London and Manchester.

Asia-Pacific

- CHINA: Tier 3 and Tier 4 cities are emerging as hotspots for affordable housing investments.

- JAPAN: Tokyo remains a prime location, but nearby regions like Hakone are seeing increased interest.

- AUSTRALIA: Coastal cities like Sydney and Melbourne are benefiting from migration patterns.

Middle East & Africa

- DUBAI: The luxury property market is recovering, driven by international events and Expo 2025.

- Egypt: Cairo is a rising investment destination with growing commercial activity.

- South Africa: Johannesburg and Cape Town are attracting investors seeking diverse opportunities.

Latin America

- BRAZIL: São Paulo and Rio de Janeiro are leading the way in urban renewal projects.

- ARGENTINA: Buenos Aires is seeing renewed interest in historic neighborhoods.

- Colombia: Medellín and Cali are attracting investors with their transformation stories.

For more detailed insights and investment strategies, explore our trend analysis and guides . Stay ahead of the market with our daily reports .

Real Estate Market Forecasts by Region

Discover detailed real estate market forecasts tailored to various regions, offering insights into upcoming trends, price projections, and market dynamics. Below is a breakdown of regional real estate market predictions for 2025 and beyond:

- United States : The U.S. real estate market is expected to experience moderate growth, with housing demand driven by population growth and low inventory levels. Key areas like major cities will see price increases, while rural markets may show slower growth due to economic challenges.

- Europe : The European market is projected to stabilize post-pandemic, with urban areas recovering strongly. Countries like Germany and France are anticipated to see modest price appreciation, while Eastern European markets may face headwinds from geopolitical tensions.

- Asia-Pacific : The Asia-Pacific region remains a hotspot for real estate investment, with China leading the way despite regulatory tightening. India and Australia are expected to see robust growth, driven by demographic tailwinds and infrastructure development.

- Emerging Markets : Regions like Latin America and Africa are poised for significant growth, fueled by urbanization and increasing middle-class demand. However, political and economic uncertainties may impact short-term trajectories.

Expert Predictions:

- U.S. Housing Market: Experts predict a 3-5% annual price increase, with multifamily properties leading the way. Single-family homes may see slower growth due to higher construction costs and interest rate fluctuations.

- European Markets: Urban areas are expected to recover, with prices rising by 2-4% annually. Rental demand is projected to rise, supporting yields for investors.

- Asia-Pacific Growth: The region’s real estate market is forecasted to grow by 6-8% annually, with tech hubs and coastal cities driving demand. India and Australia are highlighted as top performers.

- Emerging Markets Outlook: These markets offer high potential but come with risks. Brazil and Nigeria are expected to lead growth, while South Africa faces economic headwinds.

Key Factors Influencing Regional Markets:

- Economic Conditions: Interest rates and inflation play crucial roles, impacting buyer affordability and developer costs.

- Demographics: Population growth and urbanization continue to drive demand in developing regions.

- Policy Changes: Government regulations and incentives significantly influence market dynamics, particularly in rapidly growing economies.

For more detailed insights, explore our Regional Real Estate Forecasts page, offering in-depth analysis and projections for each major market area.

Real Estate Market Predictions by Region for 2024

The real estate market in 2024 is expected to show significant variations across different regions, influenced by economic conditions, demographic trends, and policy changes. Below is a breakdown of key predictions for major global regions:

- North America

- Stable growth in major cities like Toronto and New York.

- Interest rate fluctuations could impact housing affordability.

- Migration patterns and remote work trends may influence demand in suburban areas.

- Europe

- Urban markets in cities like London and Paris may see moderate price increases.

- Rural areas could benefit from reduced urban migration and lower property prices.

- Economic uncertainty due to energy crises may affect investment confidence.

- Asia-Pacific

- Strong growth in countries like India, China, and Australia.

- Urbanization and tech industry growth driving demand in cities like Tokyo and Bangalore.

- Concerns over high property prices in major hubs may lead to policy interventions.

- Australia

- Continued demand in Sydney and Melbourne due to population growth.

- Regional markets in Queensland and Western Australia may see increased activity.

- Interest rate sensitivity may impact buyer behavior in 2024.

- Latin America

- Emerging markets in Brazil and Mexico show potential for growth.

- Infrastructure investments and economic recovery may boost property values.

- Policymaker actions and currency fluctuations remain key factors.

- Africa

- Growing interest in African markets due to demographic tailwind.

- Nairobi and Johannesburg are expected to see increased demand.

- Infrastructure development projects may drive long-term growth.

Overall, 2024 is shaping up to be a year of cautious optimism for real estate markets. Investors should stay attuned to regional trends and consider diversifying their portfolios across urban and suburban areas. For detailed insights and market analysis, visit our main platform .

How Does the Real Estate Market Vary by Region?

The real estate market experiences significant variations across different regions due to a combination of economic conditions, job growth trends, housing supply, and demand patterns. Here’s a breakdown of how these factors influence market dynamics:

- Economic Conditions :

- Regions with strong local economies often see higher demand for properties. Cities with thriving industries and job markets tend to have competitive pricing and faster appreciation rates.

- Areas affected by economic downturns may experience price drops or reduced activity, depending on the severity of the downturn.

- Job Growth and Employment Opportunities :

- Metropolitan areas with expanding job markets, such as tech hubs or financial centers, typically drive up property values.

- Rural or smaller towns may see slower growth or even declines if job opportunities are limited.

- Housing Supply Dynamics :

- In cities with limited inventory, competition can push prices upward, creating a seller’s market.

- Regions with abundant supply may offer more negotiating power for buyers, leading to price reductions or slower growth.

- Demographic Trends :

- Younger generations moving to urban centers or suburban areas with good schools and amenities can boost demand in those regions.

- Retirees seeking Sunbelt destinations may impact markets in warmer climates or lower-cost areas.

- Regional Investment Potential :

- Emerging markets in growing cities often offer higher returns for investors, though with higher risks.

- Established markets may provide more stability but with moderate growth.

For example, as of June 2025, regions like Austin, Texas, or Portland, Oregon, are experiencing rapid appreciation due to tech industry growth, while traditional markets like New York or Los Angeles may see more moderate price increases. Investors should consider these factors when evaluating where to allocate their capital.

To explore region-specific insights and expert analysis, visit Real Estate Locations for detailed market reports and investment guides. Additionally, check out Zillow and Realtor.com for comparative data and listings.

Real Estate Market Predictions for Various Regions in 2024

The real estate market in 2024 is expected to show significant variations across different regions due to economic shifts, demographic changes, and policy adjustments. Here’s a breakdown of the key predictions:

Global Market Overview

The global real estate market is projected to experience moderate growth, influenced by rising interest rates and inflationary pressures. However, demand for affordable housing remains strong, particularly in urban centers.

North America

- United States: The U.S. housing market is anticipated to stabilize in 2024, with modest price appreciation in select cities. Demand for suburban properties is expected to rise due to remote work trends.

- Canada: Canada’s real estate market may see gradual recovery, driven by low interest rates and immigration policies. Major cities like Toronto and Vancouver remain attractive for international buyers.

Europe

- Western Europe: Countries like Germany, France, and the UK are likely to experience steady growth, particularly in urban areas. The demand for sustainable housing is expected to increase.

- Eastern Europe: Poland, Hungary, and Romania are projected to have robust growth due to favorable economic conditions and increasing foreign investment.

Asia-Pacific

- China: China’s real estate market is expected to rebound slightly, supported by loosened COVID-19 restrictions and government stimulus measures.

- Japan: Japan’s housing market is likely to remain subdued, with Tokyo and Osaka leading the way in terms of price stability.

- India: India’s real estate sector is poised for strong growth, fueled by urbanization and a young population. Key cities like Mumbai and Delhi are expected to drive demand.

Emerging Markets

- Latin America: Countries like Brazil and Mexico are expected to experience volatility due to economic instability and currency fluctuations.

- Africa: South Africa and Nigeria are likely to see growth, particularly in prime locations within major cities.

Key Factors Influencing the Market

Interest rate fluctuations, inflation, and geopolitical tensions will continue to shape the real estate landscape in 2024. Investors should focus on long-term trends rather than short-term volatility.

Expert Insights

Industry experts recommend diversifying portfolios with a mix of urban and suburban properties, as well as leveraging technology for better market analysis and decision-making.

For more detailed insights and actionable strategies, explore our Top Real Estate Markets and Investment Strategies sections.

Home Value Projections by Region for 2024

According to our latest analysis, housing market trends indicate varying home value projections across different regions for the coming year. These projections are based on current market dynamics, economic factors, and regional-specific trends.

Projected Home Value Changes by Region

- Appreciation in Major Metropolitan Areas: Regions like New York, Los Angeles, and Chicago are expected to see significant appreciation due to strong demand and limited supply. Prices may increase by 8-12% in these areas.

- Mild Declines in Some Suburban Markets: Suburbs surrounding major cities, such as Philadelphia and Dallas, may experience a slight decrease in home values, potentially around 2-4%, as buyers shift focus to urban centers.

- Rapid Growth in Southeastern Regions: Areas like Atlanta and Nashville are projected to see the fastest growth, with home values increasing by 15-20%. This trend is driven by population increases and job market expansion.

- Stable Performance in Midwestern States: Regions such as Kansas City and Minneapolis are anticipated to maintain stable home values, with minimal changes expected throughout the year.

Regional Highlights

It’s important to note that these projections vary depending on local economic conditions and market specifics. For instance, Real Estate Locations provides detailed reports tailored to specific neighborhoods and regions, offering a deeper insight into local trends.

Investors and buyers should also consider consulting with local real estate experts or using tools available through platforms like Real Estate Locations to make informed decisions based on the most current data.

Conclusion

Overall, the 2024 home value projections suggest a mix of growth and stability across various regions. While major metropolitan areas and southeastern regions are expected to see notable appreciation, suburban and midwestern markets may experience more moderate changes. Stay informed by regularly checking resources like Real Estate Locations for updates and insights tailored to your area.

0 Comments